2025 – A New Era in the Housing Market

Over the past two years, the U.S. housing market has experienced a seismic shift. After the COVID-era real estate boom, characterized by record-low inventory, bidding wars, and skyrocketing prices, the market is now entering a correction phase. Data from Redfin, Realtor.com, and other leading industry trackers confirm that housing inventory has increased sharply in multiple U.S. metros between June 3, 2024, and June 3, 2025. This article explores the cities with the highest year-over-year housing inventory surges, the economic and policy factors behind the trend, and what this means for buyers, sellers, and investors.

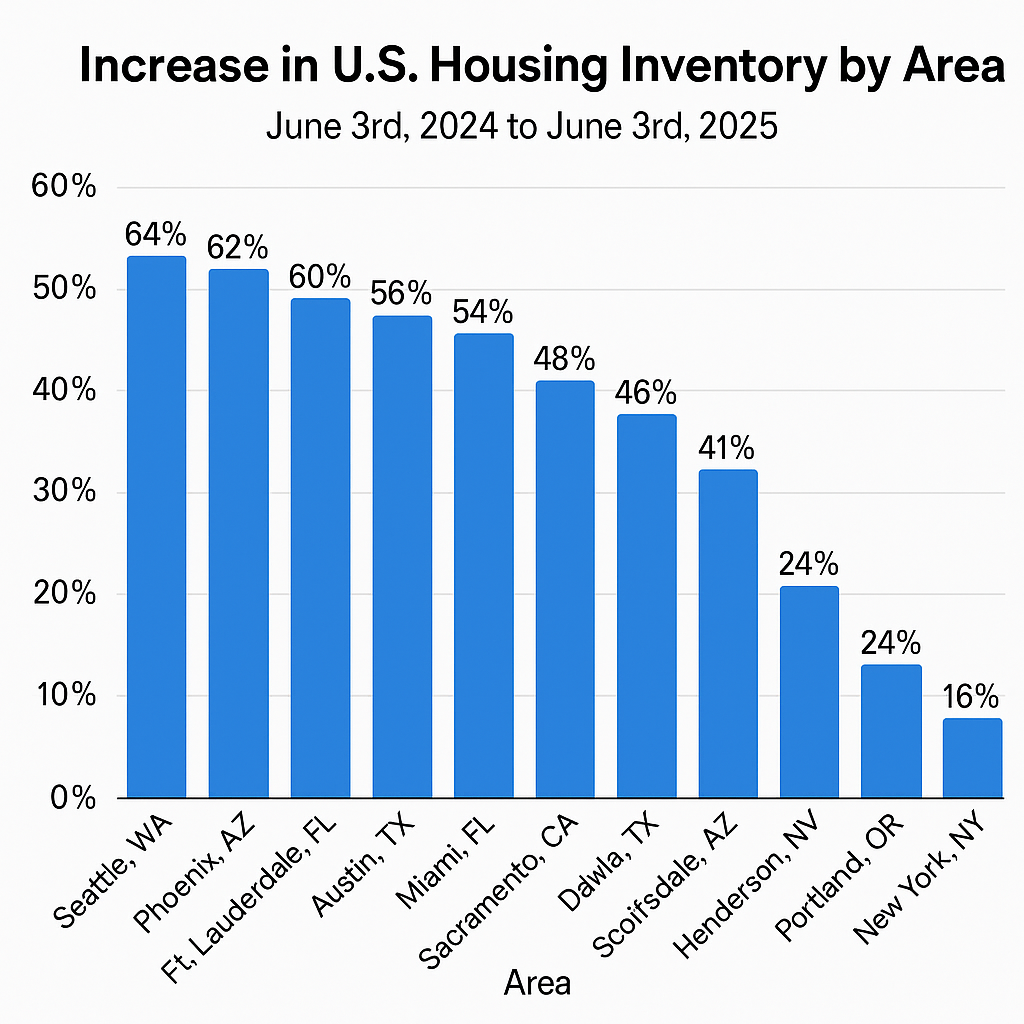

The Inventory Boom – Top Cities Leading the Charge

Among the cities showing the highest increases in housing inventory, the top performers are:

-

Seattle, WA: Up 64% (from 2,063 to 3,393 listings)

-

Phoenix, AZ: Up 62% (from 4,663 to 7,531 listings)

-

Ft. Lauderdale, FL: Up 60% (from 2,420 to 3,876 listings)

-

Austin, TX: Up 56% (from 5,253 to 8,206 listings)

-

Miami, FL: Up 54% (from 7,062 to 10,877 listings)

Each of these markets saw more than a 50% increase in active listings year-over-year. For context, a healthy housing market typically grows inventory by 5-10% annually. These surges suggest a radical reversal in market conditions.

Why Is Inventory Rising So Quickly?

Several macroeconomic and policy-driven factors have contributed to the rising number of listings:

-

Interest Rate Shocks: As mortgage rates approached or exceeded 7% by early 2025, many would-be buyers have exited the market. This shift has reduced buyer competition, leaving homes unsold for longer.

-

Pandemic Migration Reversal: Many buyers who relocated during the pandemic to Sun Belt states like Arizona, Texas, and Florida are now experiencing buyer’s remorse due to heat waves, water shortages, and rising insurance costs. Some are listing their homes and returning to core urban markets.

-

Investor Liquidation: Short-term rental profitability has declined in many areas due to regulation (e.g., Airbnb crackdowns) and oversupply. Investors are cashing out, especially in high-growth metros like Austin, Las Vegas, and Miami.

-

New Construction Push: Builders, encouraged by demand in 2021-2022, have continued to deliver new inventory despite softening demand, especially in suburban areas.

-

Inflation Pressure: Higher costs of living, layoffs in the tech sector, and broader economic uncertainty have forced more homeowners to sell.

Market-by-Market Breakdown

Let’s examine each of the top markets more closely:

Seattle, WA (+64%)

Seattle’s rise in listings is largely due to tech layoffs, remote work normalization, and an exodus from urban cores. With Amazon and other tech giants trimming headcount, sellers are listing in record numbers.

Phoenix, AZ (+62%)

Once a pandemic darling, Phoenix is seeing a reversal. Investors and remote workers flooded the market in 2021-2022. Now, extreme heat and high utility bills are driving relocations out of the area.

Ft. Lauderdale, FL (+60%)

Insurance costs in South Florida have soared, and rising sea levels are impacting buyer confidence. More sellers are testing the market while they still can.

Austin, TX (+56%)

After being one of the fastest-growing metros in the country, Austin is facing a classic boom-bust pattern. Inventory growth is outpacing buyer interest as affordability plummets.

Miami, FL (+54%)

A similar story to Ft. Lauderdale, with added pressure from foreign investors trying to exit properties they purchased during the speculative wave.

Slower Movers – Markets With Modest Growth

While some cities are seeing runaway growth in listings, others are more muted:

-

Portland, OR: +24%

-

New York, NY: +16%

New York, with over 29,000 listings, still holds the highest volume, but its percentage growth lags. Strict zoning laws and low new construction volumes mean that the city doesn’t see as many swings in inventory.

Implications for Buyers

This new inventory landscape favors buyers for several reasons:

-

Negotiation Power: Buyers now have leverage to demand concessions, price cuts, or upgrades.

-

Time to Decide: With more homes on the market and slower sales cycles, buyers are no longer under pressure to make offers within hours.

-

Better Inventory Mix: A wider range of home types, prices, and locations are now available.

However, affordability is still a concern. High mortgage rates mean that monthly payments are often still elevated, even if sale prices are slightly down.

Challenges for Sellers

Sellers now face a more competitive environment:

-

Longer Time on Market: Homes are taking weeks or months to sell.

-

Price Adjustments: More homes are undergoing multiple price cuts.

-

Higher Carrying Costs: Insurance, utilities, and taxes are climbing in many metros.

For homeowners hoping to cash out at peak pandemic-era prices, that window has closed in most regions.

What This Means for Investors

Real estate investors must now navigate carefully:

-

Flipping Risks: With softening demand and slower closings, flippers face thin margins.

-

Rental Arbitrage Declines: Short-term rental yields are compressing under new local laws.

-

Buy-and-Hold Still Viable: In metros with strong job growth and stable migration patterns (e.g., parts of the Midwest), long-term investing still has potential.

Policy and Economic Watch

Several upcoming events could shift the market again:

-

Federal Reserve Actions: Any interest rate cuts could reignite buyer demand and reduce inventory.

-

Election Year Uncertainty: Real estate historically slows in election years due to uncertainty.

-

Zoning Reform: Proposals in cities like Portland and Austin to relax zoning rules may further increase inventory.

Conclusion: 2025 Is a Year of Realignment

The sharp inventory rise across major U.S. metros signals a major realignment in the housing market. The seller’s market of 2020–2022 is clearly over in most cities. For buyers, this represents a golden opportunity—if they can navigate high rates. For sellers, it’s a wake-up call to price realistically and offer real value. And for investors, it’s a time for discipline, not speculation.

Markets like Seattle, Phoenix, and Austin are bellwethers of what’s to come for other urban regions. If current trends hold, we may be on the verge of a multi-year normalization cycle—bringing the U.S. housing market back to a more balanced, if not buyer-friendly, playing field.

Whether this is a temporary cooling or a long-term rebalancing will depend on economic fundamentals, policy shifts, and consumer confidence. One thing is certain: 2025 is shaping up to be one of the most dynamic years in housing we’ve seen in a decade.